Mortgage rates across the boards saw slight increases this week, according to Bankrate, the 30 year fixed rate mortgage (FRM) is up four basis points since last week, and sits at 3.97%. Also slowly increasing this week is the 15-year fixed rate mortgage which increased by two basis points to 3.31%. Likewise, the 5/1-yr adjustable rate mortgages had the largest jump of 13 basis points from 3.71% last week to 3.84% this week. As a result of the increasing mortgage rates, mortgage applications dropped by 1.4% last week compared to the prior, according to data from the Mortgage Bankers Association’s applications survey. This will be the third consecutive week in which mortgage applications dropped. Similarly, purchase application activity fell 3% since last week (for the third week in a row), but refinance applications rose by .1% since last week. Although there is a healthy amount of demand for consumers looking to purchase a home, the main issue is that there is an inadequate supply level.

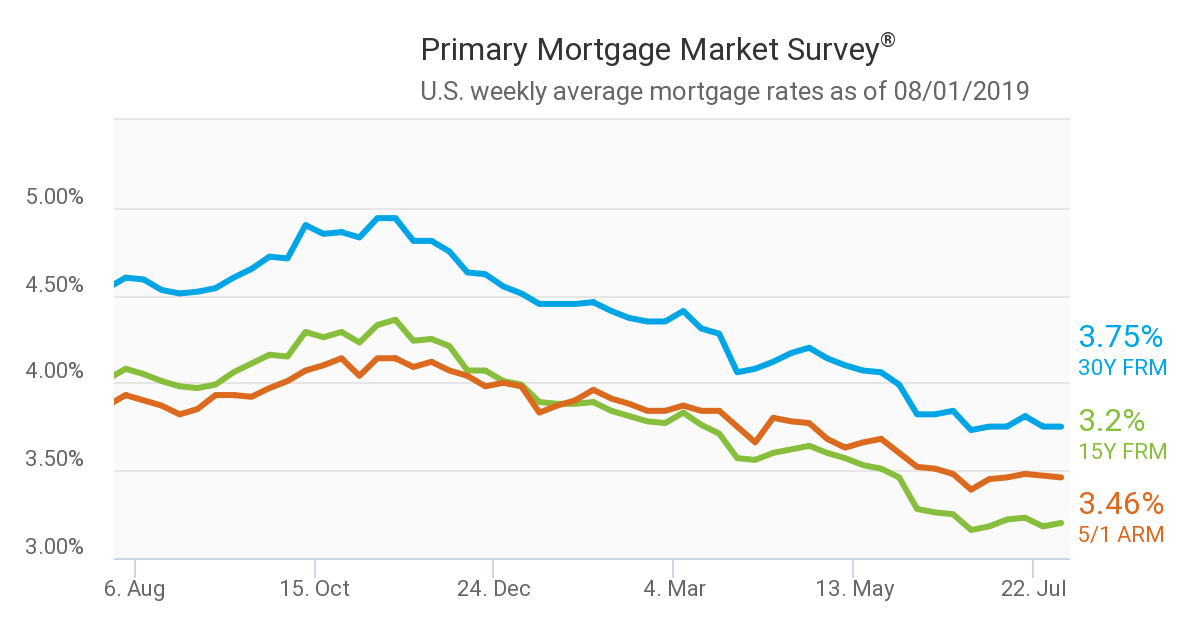

Following suit, Freddie Mac has the mortgages rates listed lower than Bankrate with the 30 year FRM at 3.75% a zero basis point change since last week. The 15-year FRM saw a slight upward trend of two basis points from 3.18% to 3.20%. In contrast, the 5/1 year ARM decreased by one basis point since last week and now sits at 3.46%. These mortgage rates show stability which reflects the improvement in the economy from the trouble seen earlier in the year. These low, stable mortgage rates combined with a strong labor market and high consumer confidence will pave the way for continued improvement in home sales for the second half of the year.

Below is a graph from Freddie Mac showing the U.S. weekly averages for 30-yr FRM, 15-yr FRM, and 5/1-yr ARM as of August 1, 2019.